BUILT BY INVESTORS DRIVEN BY EXPERTISE POWERED BY DATA

Your go-to platform solution for everything ESG and Sustainability risk management,

regulatory alignment, and best-practice sustainable Investing.

About Us

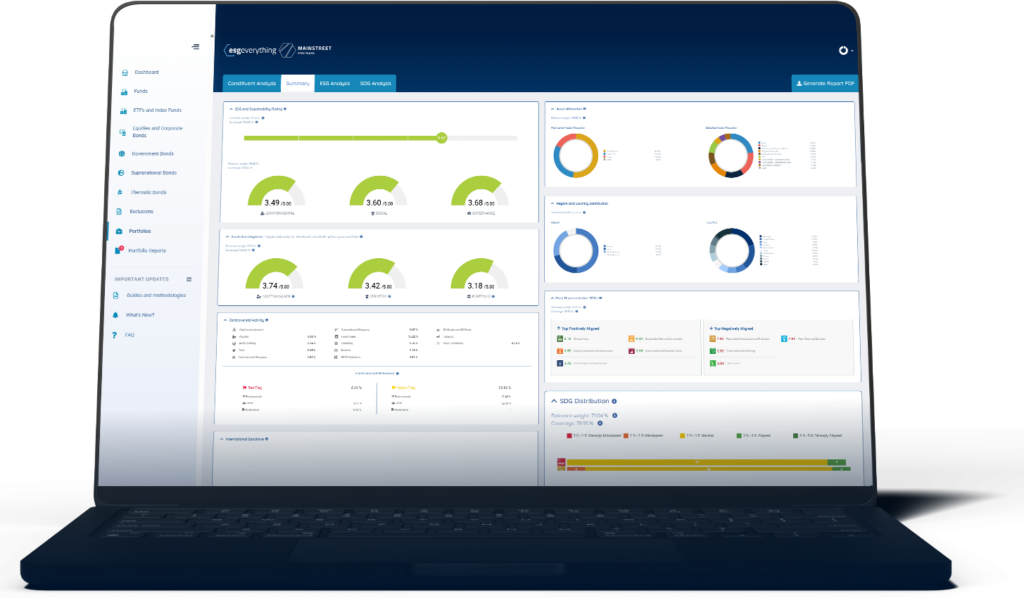

At MainStreet Partners, our foundation lies in unique and robust proprietary methodologies, setting us apart in the industry. With over 17 years of experience in the field of Sustainable Investing, we’ve crafted esgeverything – a cutting-edge platform technology, designed by investors, for investors. It provides fundamental data and tools for professional investors to meet ESG and Sustainability requirements across diverse portfolios, from Funds to Fixed Income, to Equities.

Whether managing ESG risks, navigating regulatory shifts, or fostering sustainable capital allocation, esgeverything offers an accountable solution. We blend industry expertise, advanced technology, strategic partnerships, and reliable data and analysis to simplify the complexities of ESG and Sustainability challenges, ensuring seamless integration into investment decision making and reporting.

The Benefits of Using esgeverything

With access to an extensive spectrum of Environmental, Social, Governance and Sustainability data and tools, esgeverything facilitates:

Holistic ESG Risk Management

Seamlessly navigate ESG risks and opportunities across Equities, Fixed Income, Funds, and ETFs, fostering effective portfolio management.

Regulatory Adherence

Stay ahead of ever-evolving sustainability regulations effortlessly, ensuring your investment strategies remain aligned with the latest updates.

Sustainable Investment

Construct portfolios firmly rooted in sustainability principles, enabling the creation of resilient investment portfolios.

Platform Solutions

Quality is our best policy. We go above and beyond to empower investors with the highest standard of data and coverage required to make informed sustainable investment decisions.

Regulatory Data

In a world of ever-evolving sustainability regulation, ESGeverything simplifies alignment of your investment strategies and periodic reporting needs, with comprehensive, all-in-one solutions.

ESG and Sustainability risk

Manage ESG and Sustainability risk with ESG and Sustainability ratings and analysis, based on robust proprietary methodologies across Equities, Funds, ETFs, Fixed Income and labeled Fixed Income instruments.

Controversies and Exclusions

MainStreet Partners has built and continuously maintains a list of companies exposed to activities that generate revenue, or are exposed, to activities that have adverse impacts on the environment and society enabling you to identify and screen those involved in controversial sectors like Weapons, Gambling, Arctic Drilling, and Oil Sands.

ESG and Sustainability analysis and non-financial reporting solutions

Simply upload your portfolio to instantly receive a thorough ESG and Sustainability analysis, empowering you to make informed decisions with ease.

Impact Data

Harness high-quality data to gain granular insights into a company’s alignment – both positive and negative – to each of the 17 UN Sustainable Development Goals.