As southern Europe swelters under a record-breaking summer heatwave, the signs of climate risk are no longer theoretical – they are blisteringly real.

From scorched vineyards in France to shrinking reservoirs in Spain, the environmental urgency that once fuelled the ESG boom is now playing out in real time. Yet, just as the need for sustainable finance intensifies, the narrative around it is entering a period of growing ambiguity and fatigue.

The past 18 months have tested the resilience of ESG and Sustainable Investing. Once the darling of capital flows and policy frameworks, the sector has recently faced intense scrutiny over performance, transparency, and political pushback. Still, the long-term trajectory remains intact. The real question now is how the market evolves in a world where visibility is no longer a guarantee of credibility.

A Bipolar Regulatory World

The divergence in regulatory approaches between the US and Europe is sharpening.

Across the Atlantic, the re-emergence of Trump-era narratives has led to a chilling effect on ESG adoption – The US exit from the Paris Agreement, for the second time, – is symbolically and practically significant.

Meanwhile, Europe is scaling back some of its ambitions through the Omnibus Package, which could limit mandatory reporting under Corporate Sustainability Reporting Directive (CSRD) and serve to increase data fragmentation.

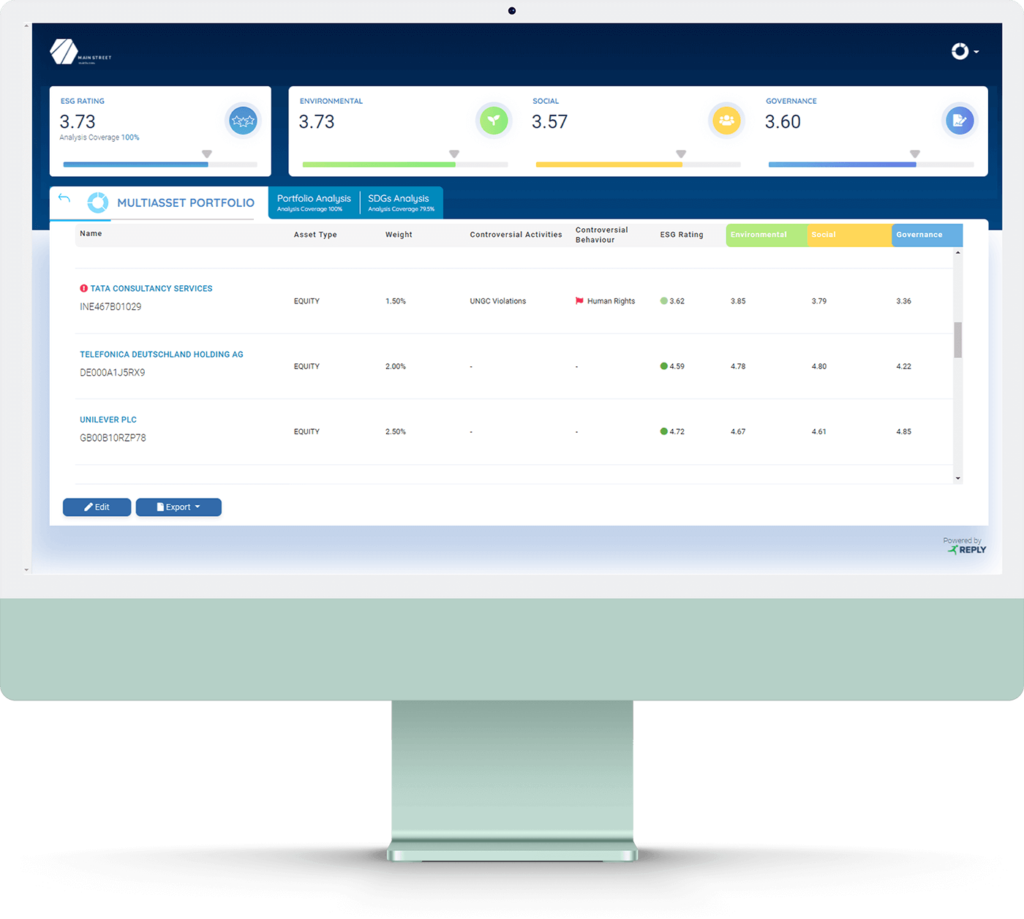

However, despite slower progress in some areas, product-level regulations in the EU continue to move forward. The ESMA guidelines on fund names incorporating ESG or sustainability-related terms came fully into effect on 21 May 2025. These require that at least 80% of a fund’s assets promote ESG characteristics – and even stricter thresholds apply when sustainability terms are used.

Greenhushing

Faced with reputational risk and high compliance costs, asset managers are increasingly opting for discretion.

Greenhushing – the deliberate under-reporting of sustainability practices – has quietly replaced greenwashing as the industry’s dominant defensive tactic; a trend that only reflects the growing complexity of navigating global rules and the risk of regulatory misalignment, particularly for firms with a transatlantic footprint.

UK vs EU: Diverging but Complementary Paths

In the UK, Sustainability Disclosure Requirements (SDR) are widely seen as more functional and investor-focused than the EU’s Article 6/8/9 SFDR framework.

With the FCA introducing sustainability labels such as “Sustainability Focus” and “Sustainability Improvers,” many hope the EU’s upcoming Q4 SFDR review will align more closely with the UK model. Indeed, the Platform on Sustainable Finance has already proposed a new categorisation system mirroring SDR’s logic – grouping funds into “Sustainable,” “Transition,” and “ESG Collection” categories.

A more unified framework would undoubtedly be welcomed by asset managers. As of now, discrepancies between SFDR and CSRD risk distorting data quality and investor comparability – especially as the Omnibus Package excludes over 80% of previously covered firms from mandatory disclosure.

Overall, fund names are seen to strongly influence, particularly retail, investor decisions and this has been a positive step in combatting greenwashing with the previous 6-9 months seeing widespread changes across the market.

Sustainable Bonds: A Market Reinventing Itself

Despite the ESG backlash, Green, Social, and Sustainability Linked (GSS) bonds are set for another record year, with over $1 trillion in issuance projected for 2025.

Key themes include the refinancing of maturing debt, the critical moment for sustainability-linked bonds, and the implementation of the EU Green Bond Standard (EuGBS).

With new fund naming guidelines applying to GSS funds as well, ESMA now requires these products to meet Paris-Aligned Benchmark criteria – a move that has elevated standards but also narrowed the investable universe.

Future

If last year was about damage control, the next phase is about recalibration. Regulatory frameworks are maturing, investor scrutiny is intensifying, and the political context remains volatile.

Yet structural drivers – from climate change to biodiversity loss – remain as urgent as ever.

In a world where silence can be as misleading as exaggeration, sustainable finance must now prove it can speak with clarity, evidence and impact.

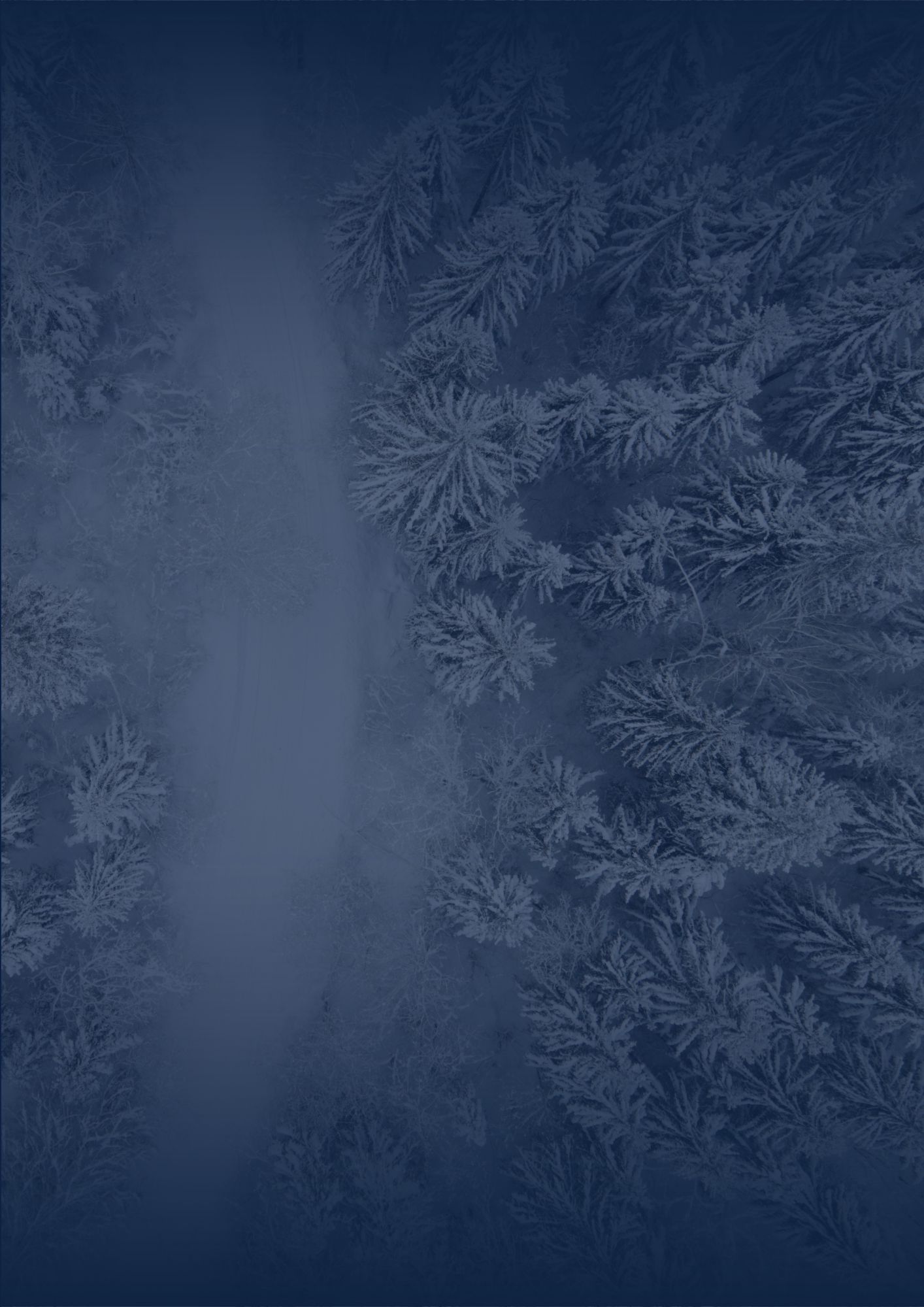

Investors should remain vigilant, as determining the true ESG and sustainability credentials of a fund requires thorough due diligence—there are no shortcuts.